Everything You Need to Know to Stay Compliant and Streamline Your Business

As of 2025, Jordan's Income and Sales Tax Department (ISTD) requires businesses to issue e-invoices that include QR codes as part of a nationwide digital transformation. Whether you're a small retailer, a restaurant owner, or an accounting professional, complying with this regulation is not just a legal obligation—it’s an opportunity to modernize your operations.

In this blog, we’ll walk you through everything you need to know about tax-compliant invoicing in Jordan and how FawtraTechs makes it seamless.

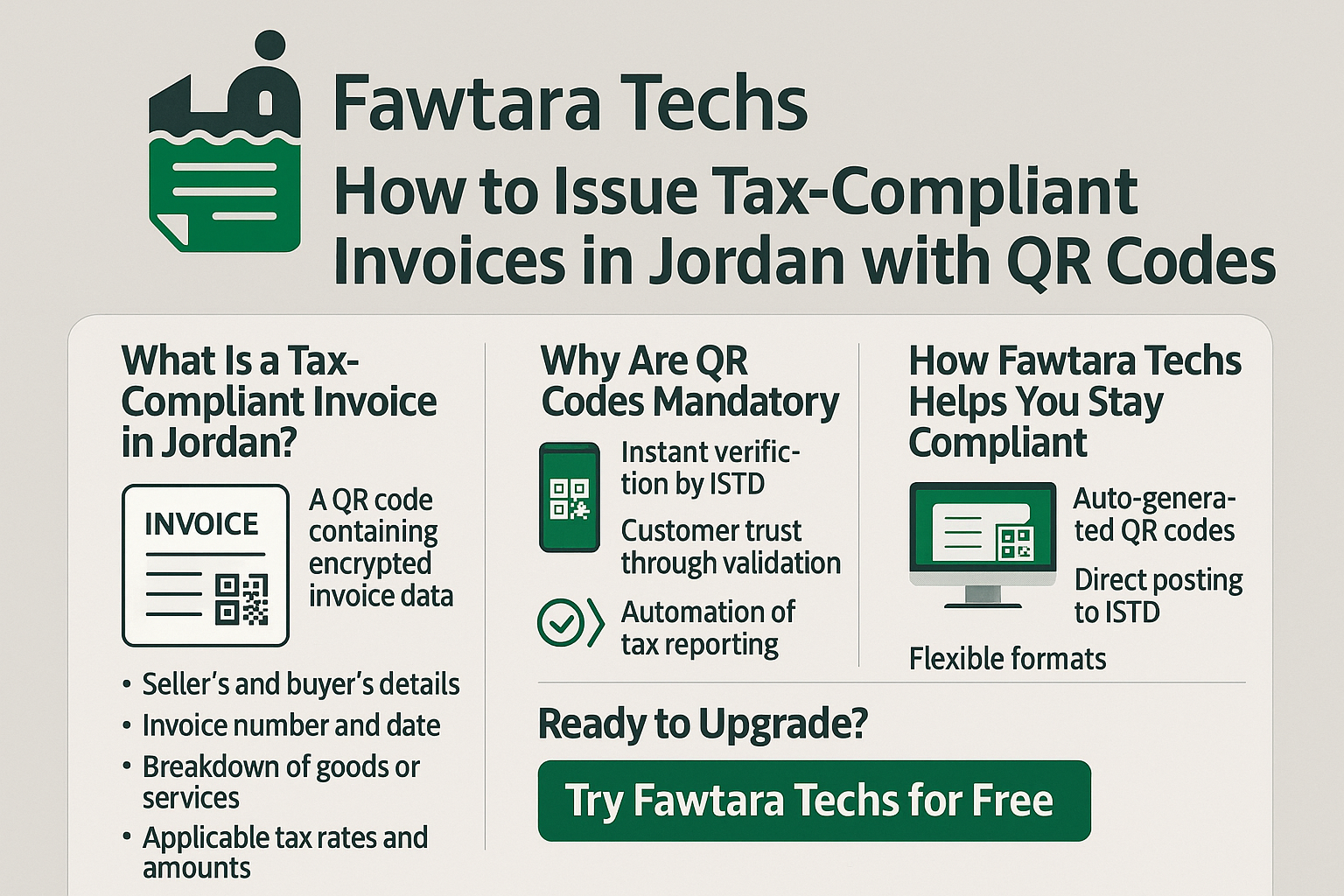

✅ What Is a Tax-Compliant Invoice in Jordan?

A tax-compliant invoice must include:

- Seller's and buyer's details

- Invoice number and date

- Breakdown of goods or services

- Applicable tax rates and amounts

- A QR code containing encrypted invoice data

- Integration with Jordan’s e-invoicing system

The purpose of this setup is to ensure transparency, traceability, and instant reporting to the ISTD.

📌 Why Are QR Codes Mandatory?

The QR code is not just a tech add-on; it's a requirement under Jordanian tax law. It allows:

- Instant verification by ISTD

- Customer trust through easy validation

- Automation of tax reporting

By scanning the QR code, tax officials or clients can verify the invoice authenticity and content within seconds.

💻 How FawtraTechs Helps You Stay Compliant

FawtraTechs is a smart invoicing and POS platform built specifically for Jordanian businesses. Here’s how it supports tax-compliant invoicing:

🔹 1. Auto-generated QR Codes

Every invoice issued through FawtraTechs comes with an embedded QR code that complies with ISTD requirements.

🔹 2. Direct Posting to ISTD

Invoices are automatically posted to the ISTD system, saving you manual time and ensuring full compliance.

🔹 3. Flexible Formats

Issue invoices via:

- Web platform

- Mobile app

- POS terminals (Retail / Restaurant / Supermarket versions)

🔹 4. Archived & Searchable

All invoices are securely stored, searchable, and exportable for audit or financial reporting needs.

📊 Benefits of Digital Invoicing with FawtraTechs

- 🔐100% Tax Compliance

- 📲Mobile and desktop access

- ⏱️ Instant invoice generation

- 📈Smart reports and analytics

- 🧾Audit-ready with all legal requirements met

💬 Ready to Upgrade?

Stop worrying about manual errors, missed regulations, or delayed submissions.

👉 Try FawtraTechs for Free

✅ Issue QR-code-ready invoices in minutes

✅ Stay compliant with Jordan’s 2025 tax regulations

✅ Get full support and training from our local team

🔍 Resources

- الادلة الارشادية لنظام الفوترة الوطني - وزارة المالية دائرة ضريبة الدخل و المبيعات

- FawtraTechs Smart Invoicing Platform